Has France Taken Over Nigeria’s Tax System?

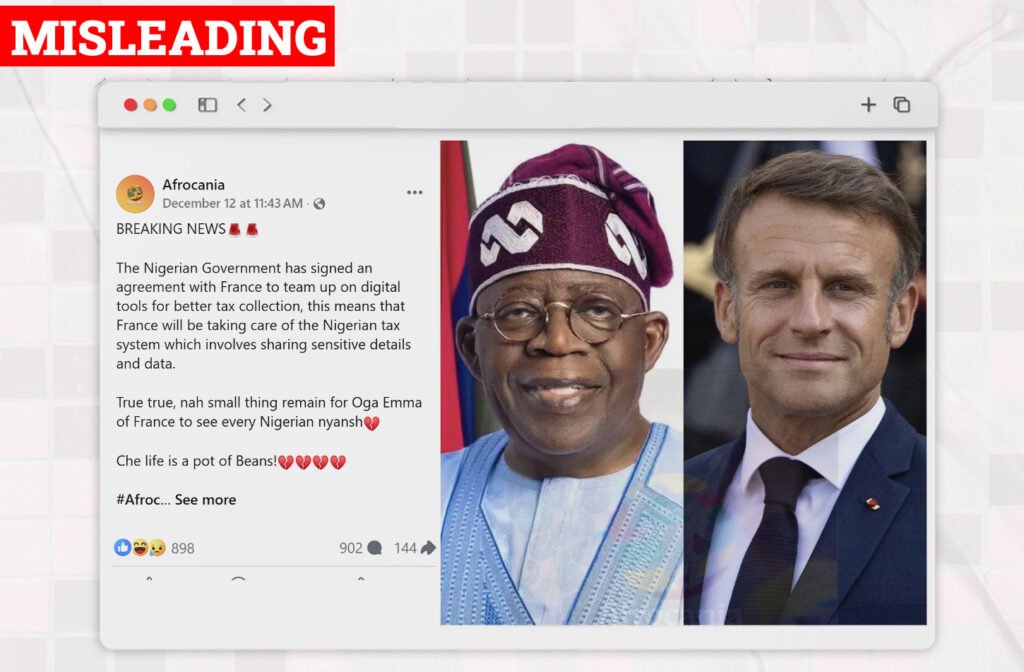

Facebook user @Afrocania says that the Nigerian Government has signed an agreement with France that allows the country to take over Nigeria’s tax system and access sensitive taxpayer data. According to the post which had an image of President Bola Tinubu and Emmanuel Macron, Nigeria is teaming up with France on digital tools for better tax collection, and it involves sharing sensitive details and data.

VERIFICATION

On December 10 2025, Nigeria’s Federal Inland Revenue Service, FIRS, and France’s tax authority, the Direction Générale des Finances Publiques, DGFiP, signed a memorandum of understanding to work together on modernising Nigeria’s tax administration using digital tools and to share expertise to improve revenue systems. The pact aims to strengthen digital tax administration, boost capacity and support reforms ahead of the transition to the Nigeria Revenue Service in 2026.

Some political parties like the African Democratic Congress, ADC, raised concerns that the deal could threaten Nigeria’s sovereignty or data security, and they want more transparency or termination of the agreement.

According to the official statement from FIRS, the MoU does not give France access to Nigerian tax databases, systems or operational control. Nigeria’s data protection laws and cybersecurity rules remain fully in force, and the collaboration is described as technical assistance, capacity building and knowledge exchange rather than outsourcing or handing over control.

Adedeji said the partnership reflects a shared ambition to build “stronger, more resilient and forward-looking” tax systems at a time when global public finance is being reshaped by technology, artificial intelligence and cross-border digital commerce. He identified digital transformation as one of the central pillars of the pact, explaining that Nigeria aims to tap into France’s expertise in automated compliance systems, data-driven audits and advanced taxpayer service platforms.

However, there has been no clear statement specifying the exact categories of information to be shared between the Federal Inland Revenue Service and France’s Direction Générale des Finances Publiques, nor the level of sensitivity of such data.

CONCLUSION

The claim that the Nigerian Government has signed an agreement that allows France to take over Nigeria’s tax system and access sensitive taxpayer data is MISLEADING. While it is true that Nigeria signed a tax cooperation agreement with France, it is not a takeover of Nigeria’s tax system.