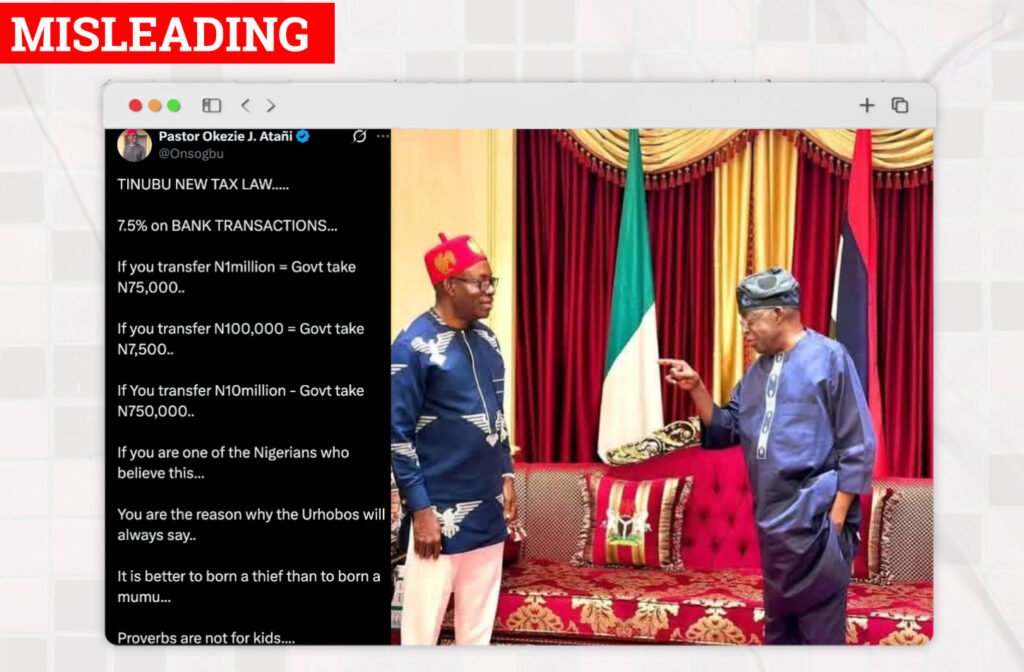

CLAIM: Nigeria’s New Tax Law Charges 7.5 Percent On All Bank Transfers

On January 15, 2026, an X user @Onsogbu asserted that a new tax law under President Bola Ahmed Tinubu is imposing a 7.5 percent charge on every bank transfer. The post has an image of President Tinubu and Anambra State Governor, Professor Charles Soludo, with the caption, “TINUBU NEW TAX LAW…..7.5% on BANK TRANSACTIONS…If you transfer N1million = Govt take N75,000..If you transfer N100,000 = Govt take N7,500.. If You transfer N10million – Govt take N750,000.. If you are one of the Nigerians who believe this… You are the reason why the Urhobos will always say.. It is better to born a thief than to born a mumu… Proverbs are not for kids….

When this report was published, this claim had about 282,400 views and over 2,300 replies, reposts, quotes, likes, and bookmarks. In the comment, @masuzafi said “Most people didn’t know that it is those middle men charges that are being taxed, the criminal network ussd N 6 charge will be charged 7.5%. The charge is on the service not the money.” and @cityboyofabuja wrote “Stop misleading Nigerians this is not correct. It’s 7.5 vat on what the Bank charges you not on the whole amount please.”

VERIFICATION

The Vanguard had reported that the Federal Government has directed banks and financial technology firms to begin collecting and remitting a 7.5 percent value-added tax, VAT, on selected electronic banking services, effective Monday, January 19, 2026. But another news outlet, Punch Nigeria reported that the Federal Government has addressed the misinformation on the imposition of VAT on banking services, including electronic money transfer, fees and commission, describing the information as incorrect and misleading. In a statement released on January 16, 2026, the Nigeria Revenue Service said that VAT on banking services is not a new policy, the existing tax laws already require banks to charge and remit VAT on fees and commissions for services such as transfer fees, USSD charges, card issuance fees, and account maintenance charges.

The clarification followed public complaints from bank customers who believed fresh charges had been imposed on routine services at a time when inflation and higher living costs are squeezing households.

The 7.5 percent VAT mentioned in the viral post applies only to bank service charges, not to the money being transferred. Banks usually charge a small flat fee, such as 10 or 50 naira, for transfers. VAT is then calculated on that fee alone. For example, if your bank charges 50 naira for a transfer, VAT is 7.5 percent of that fee, which is only 3.75 naira. Your total deduction becomes 53.75 naira, not thousands of naira.

CONCLUSION

The claim that Nigerians are now required to pay 7.5 percent on every bank transfer is MISLEADING. The VAT does not apply to the total sum of money to be transferred but on the bank charges for every transfer.